3 Year End Tips for Real Estate Agents to Better Manage Their Money and Build Wealth

by Carrie Gallaway, CFP®, CeFT®

Real Estate is a significant industry here in Hudson County. Here are some tips for our friends in that business, as they prepare to manage their own assets.

- Plan for taxes:

When you hear the word tax, what goes through your mind? Does your mind start to wander, your eyes glaze over, and you start thinking about everything besides taxes? If you are like most people, taxes and tax planning is not top of mind and you have no interest in understanding the tax code. You just want your taxes to be done right, you don’t want to overpay, nor have a penalty. However, with that said, and especially as a real estate professional, it’s really important to stay current on your tax planning throughout the year.

As a real estate professional, your income varies and is not always consistent. It may be hard to know what to pay towards taxes when you’re not even sure what your commissions will be next month or for the year! Planning for how you’ll pay your taxes takes a little work, but it can be done.

To help real estate professionals with planning, we suggest setting up a separate brokerage account that is separate and apart from your checking or savings account. A portion of every commission check received is allocated to the brokerage account. This money is segregated and can be used to cover taxes when needed. You may also want to consider investing the money into a conservative investment that may improve your return over what a bank account earns.

It is important to confer with your tax professional throughout the year. Checking in with your accountant will allow her to advise you if a change is needed in how much you’re paying taxes.

If you are paying estimated payments for taxes, make sure you set reminders on your calendar to write the checks and mail them. In addition, set those reminders for quarterly check-ins with your financial planning team as well. Working closing with a wealth advisor can help facilitate the coordination as well.

- Track your money:

Your revenue or closed business during the year will affect your income and the taxes you need to pay. Create a system to track your commissions but also your expenses. You want to make sure you capture all business related expenses such as gas mileage or marketing expenses. We suggest reviewing expenses and income monthly. When you review your credit card bill and receipts monthly, it’s manageable and not overwhelming. Spending 30 minutes a month is much easier than trying to block out 8 or 10 hours of time in December. You may want to have a separate credit card or debit card that you only use for business purposes. A separate credit card for business expenses will make tracking easier.

Tracking your money will also provide you insight into what you’re saving as well as spending. If you’re not saving money like you want, you can make a change.

- Plan for your life:

Just as you need to plan for how you’ll pay taxes, you should have a plan for your money long term. Of course, you will have costs now in order to live, but you also need to have a plan for how you’ll pay for life in the future.

We recommend creating a longer-term savings and investment strategy that incorporates a customized retirement plan for you. There are many types of plans that can be used, from SEP IRAs, to Solo 401(k)s, to Pension plans. All of the plans let you contribute a portion of the money you earn annually thereby deferring taxes into the future.

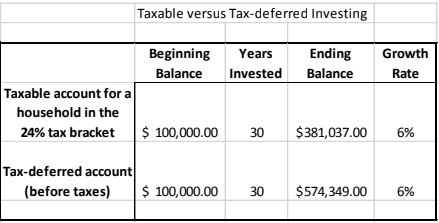

However, once money is contributed to the retirement plan, it needs to be invested. When tax deferral and compounding of investment growth are combined, the growth, over time, may be greater than in a taxable account.

Here is an example to help illustrate the point:

Carrie Gallaway, CFP®, CeFT®, is a Financial Advisor with over 20 years of industry experience. She is a principal at YorkBridge Wealth Partners, an independent wealth management firm. Carrie is also the author of the bestselling book, Your Money, Your Life and a Hoboken resident for 18 years (photo by Marie Papp).

Carrie Gallaway, CFP®, CeFT®, is a Financial Advisor with over 20 years of industry experience. She is a principal at YorkBridge Wealth Partners, an independent wealth management firm. Carrie is also the author of the bestselling book, Your Money, Your Life and a Hoboken resident for 18 years (photo by Marie Papp).

Previous Article

Previous Article Next Article

Next Article 51 Year-Old Hoboken Man Charged With Public Lewdness in Pier A Park

51 Year-Old Hoboken Man Charged With Public Lewdness in Pier A Park  HOBOKEN MAYORAL RACE: C’mon In, the Water’s Warm… | EDITORIAL

HOBOKEN MAYORAL RACE: C’mon In, the Water’s Warm… | EDITORIAL  Hudson Theatre Ensemble’s “Silly on Sixth” to Perform “Cinderella! Cinderella!”

Hudson Theatre Ensemble’s “Silly on Sixth” to Perform “Cinderella! Cinderella!”  HE SAID, SHE SAID: Mile Square Theatre to Host “The Great Love Debate”

HE SAID, SHE SAID: Mile Square Theatre to Host “The Great Love Debate”  Charity Date Auction at McSwiggan’s — THURSDAY @ 7

Charity Date Auction at McSwiggan’s — THURSDAY @ 7  PART OF THE SOLUTION: The Waterfront Project’s Summit on Homelessness — OCTOBER 2-3

PART OF THE SOLUTION: The Waterfront Project’s Summit on Homelessness — OCTOBER 2-3  IRISH EXIT: Hoboken LepreCon Pub Crawl Falls Flat

IRISH EXIT: Hoboken LepreCon Pub Crawl Falls Flat  NICE WORK: Hoboken Crime Rate Sees Double-Digit Drop in 2015

NICE WORK: Hoboken Crime Rate Sees Double-Digit Drop in 2015