Hoboken Taxes Steady, Hudson County Taxes Rise

The Hoboken City Council adopted a 2015 budget that manages to hold Hoboken taxes steady via cost-cutting and “increased efficiencies.”

However, Hudson County’s budget proposal will see an 11.5% increase in Hoboken’s levy, contributing to an overall $352 annual tax increase for the average Hoboken property.

“In Hoboken, we have made difficult staffing decisions, tightened our belts, and sought out efficiencies to cut costs and stabilize taxes,” said Mayor Dawn Zimmer in a statement. “Despite these efforts, our taxpayers still see their property tax bills go up primarily because of County taxes. Part of the reason Hoboken’s share of County taxes has gone up is because our property values are rising faster than in the rest of the County.”

In a conversation with hMAG.com, Hudson County Freeholder Anthony Romano said, “That’s true—Hoboken and Jersey City are basically penalized for having such high property values and being so successful—but that’s the State’s formula, done on the State level.”

However, Romano explained that a number of additional factors have lead to the Hudson County tax increase. “The City gets a lot of support from the County,” says Romano, citing a number of projects and cultural initiatives where Hoboken has turned to Hudson County for support. As the City trims its budget, according to Romano, it has turned to the County more often. “Anything Hoboken asks for, we try our best to give it to them.”

Meanwhile Romano indicated that he does not support the current budget proposal, and is currently looking at ways to trim alleviate the strain on the Hoboken taxpayer.

Next Thursday, June 4, 2015 at 6:00pm, the Hudson County Board of Chosen Freeholders will host a budget forum in Hoboken City Council chambers, giving the public an opportunity to express their opinion.

Previous Article

Previous Article Next Article

Next Article HOBOKEN ARTISTS STUDIO TOUR: Explore the Cultural Assets Right Next Door—SUNDAY, NOV. 6th

HOBOKEN ARTISTS STUDIO TOUR: Explore the Cultural Assets Right Next Door—SUNDAY, NOV. 6th  Council Members Reportedly Removed From Hoboken City Hall By Security

Council Members Reportedly Removed From Hoboken City Hall By Security  Hoboken Police Seek Help in Locating 21-Year Old Autistic Male

Hoboken Police Seek Help in Locating 21-Year Old Autistic Male  NJ Supreme Court to Review Appeal of Monarch Project on Hoboken Waterfront

NJ Supreme Court to Review Appeal of Monarch Project on Hoboken Waterfront  Center for Translational Orthodontic Research Opens CTOR Academy in Hoboken

Center for Translational Orthodontic Research Opens CTOR Academy in Hoboken  PURPLE REIGN: Talent-Packed Tribute to Prince — FRIDAY @ Maxwell’s

PURPLE REIGN: Talent-Packed Tribute to Prince — FRIDAY @ Maxwell’s  Hoboken Guards 5th Annual Pub Crawl & Player Auction

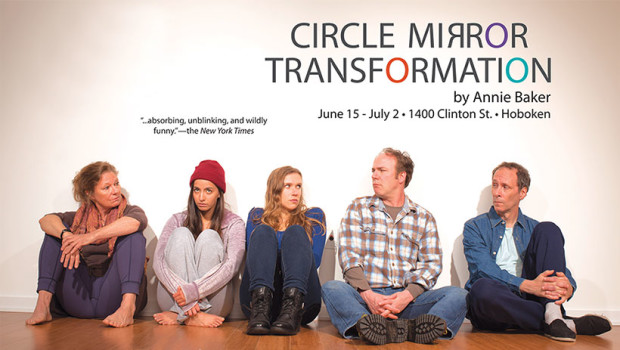

Hoboken Guards 5th Annual Pub Crawl & Player Auction  CIRCLE MIRROR TRANSFORMATION — Mile Square Theatre Talks to Hoboken Internet Radio About Their Inaugural Production

CIRCLE MIRROR TRANSFORMATION — Mile Square Theatre Talks to Hoboken Internet Radio About Their Inaugural Production